Pantheon Resources Trade Idea: Shares bashed, but is this a market overreaction?

Pantheon's shares have taken a battering this week on news that the Megrez-1 TS1 Target was predominantly water bearing. However, the company believe that data gathered, increases confidence in the productivity and hydrocarbon potential of the intervals higher with 5 futher intervals to test.

Pantheon are an Oil & Gas company operating in the Northern Slope of Alaska with a 100% working interest accross some c.258,000 acres of State Lands. The company has Certified Resources of c.2.6 billion bbls of oil equivalent.

The company are currently in the process of testing the Aphun East Megrez-1 Discovery looking to confirm 'an additional' commercially viable resource. It's worth noting that success here is an 'upside case' to existing certified resources. The company will test 6 separate horizons as part of the programme.

In fact the company reported this week, the first preliminary results from testing at the first zone, TS-1. Unfortunately, the testing didnt't result in any appreciable hydrocarbons being evident during flow-testing and the TS-1 horizon will be abandoned.

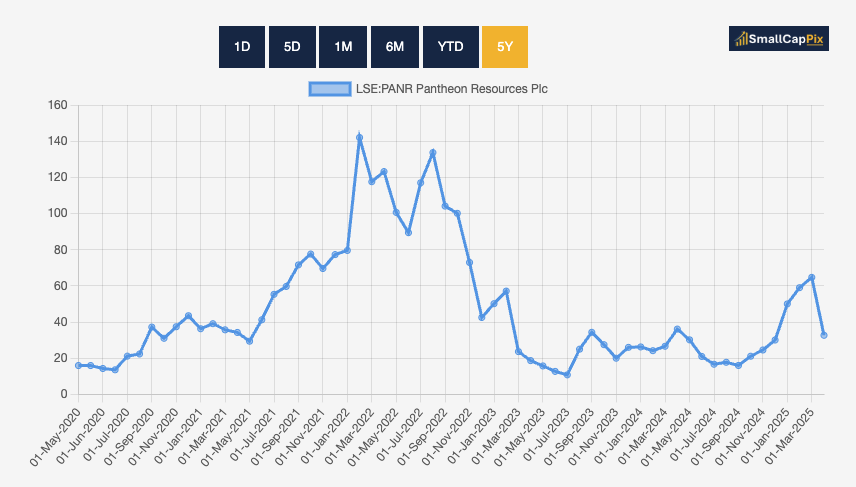

I probably don't need to explain to you right now that this is a difficult market, with Trump causing Tarrif mayhem and the oil price under pressure, and so un-surprisingly, Pantheon's shares took a big hit on the news dropping c.50% from highs at the beginning of the month.

However, this appears to be a huge market over-reaction in my opinion, given the majority of the company's valuation is/should be supported by existing Certified 2C resources of 1.6 Bbbl of OIl 6.6 Tcf Gas, and the Megrez-1 prospect should be considered a further 'upside case', and is in fact, only 1/6th tested anyway!

The CEO, commented:

"Whilst at face value it appears disappointing that the first and deepest interval did not produce material hydrocarbons, when you take a closer look, the data we gathered leaves us with increased confidence in the five shallower and more productive horizons that remain to be tested. We are confident that these further five zones will, in aggregate, add high quality inventory to our already significant 1.6 billion barrels of certified resources in Ahpun and Kodiak. We look forward to sharing the next set of results as they become available."

So herein lies the trade opportunity...

Listening in on an investor call with Management today, here are some bullets that I believe offer a trade opportunity from the current share price and additionally, potential further upside upon success as Megrez-1.

- Megrez-1 has already confimed the presence of hydrocarbons

- TS1 was just one of 6 horizons to be tested

- The TS1 horizon could be a transition/migratory zone, was deeper, and the likelihood of water increases at depth

- The data gathered from testing increases the robustness of log data

- Log data and analysis support the thesis that higher saturations and mobile oil will be found in the shallower stratigraphic sequences

- The shallower stratigraphic sequences are yet to be tested !

- The oil is not heavy, but light hydrocarbons

- Higher chance of success in flowing commercial quantities the higher up the well-bore the company go.

So in essence, despite initial sceptisicm on bulletin boards etc (gritted teeth!), there is a 'boat load' of testing yet to do which will span another 2-3 months or so, with associated news-flow, and as explained the further five horizons up the well-bore should have a higher chance of a positive outcome, but this is OIl & Gas and of course, nothing is ever certain until proven so, so it's prudent to be aware of risks!

The company are cashed up with c.£10M on the balance sheet so its not like the begging bowl will be coming out anytime soon.

In addition to the on-going test programme at Megrez-1, the company are in the throws of planning for first production in 2028 with a 'Show Me' well planned for either this or early next year. This should upgrade the resource and facillitate the likes of project financing.

Drill, Baby, Drill

Pantheon's projects are set to benefit from the Presidential Executive Order, 21 Jan 2025 “Unleashing Alaska’s Extraordinary Resource Potential” which is timely given the stage Pantheon are at. The US Executive Order policies include:

- expediting the permitting and leasing of energy and natural resource projects in Alaska

- prioritizing the development of Alaska’s natural gas (LNG) potential including the sale and transportation of Alaskan LNG...

So, in a nutshell, one could strongly argue that a c.50% drop in share price is way overdone, when you consider a bulk of the company's valuation is supported by a large Certified Oil & Gas resource, that that resource is now only recognised at c.22cents a barrel, the company have a strong cash position and are funded for operations and just 1/6th of testing has been completed on what would be an additional 'upside resource' anyway, albeit it a transformational one!

I hold a position in the company!