5 Reasons to Add Harena Resources to Your Watchlist

Harena is London's latest stock market entrant offering early stage exposure to a hot commodity, namely Rare Earths, particularly the likes of critical magnet metals Neodymium (Nd), Praseodymium (Pr), Dysprosium (Dy) and Terbium (Tb). Here are 5 Reasons to watch it!

In our last blog, we introduced Harena Resources, one of a few options to gain exposure to a globally significant advanced stage Rare Earths Development project.

Harena listed on the UK main list in March and since then the company have already reported on further high grade potential at Ampasindava along with progress on the Mining Study which will culminate in a PFS, a key step to achieving a Full Mining License.

In this blog we'll highlight '5 Reasons' you should take a look at Harena

Rare Earths - It's what everyone is talking about!

Even if you are not an investor, you'll have probably heard of Rare Earths or seen them repeatedly appearing in the news headlines.

Essentially, Rare Earths or REE"s are a group of 17 chemically similar metallic elements. It would take too long in this blog to list them all and their usages so all you need to know is, they are critical elements/minerals that are used in a multitude of sectors including defense, energy and technology.

Perhaps the most well known of the elements are Neodymium (Nd), Praseodymium (Pr), Dysprosium (Dy) and Terbium (Tb) all essential for powerful magnets used in the likes of wind turbines, EV's and even the likes of nuclear reactors.

Despite their name, these elements are not necessarily rare in the Earth's crust; however, they are rarely found in concentrated, economically viable deposits, which makes them difficult and costly to mine and refine. This is where the benefit of Harena's Ionic Clay Ampasindava project becomes of interest which lends itself to a more simplified extraction process with a zero-harm environmental model.

Advanced Stage, Globally Significant Project

Harena curently owns 75% of the Ampasindava Ionic Clay Rare Earths deposit in Madagascar. The project is globally significant in terms of size with a large 606Kt Total Rare Earths Oxide resource.

The project has had some c.$20m of historic spend and the project comes to market as a 'Development Stage' play with exploration completed, a JORC Compliant resource and a significant amount of Base Line Metallurgical test-work completed.

There is therefore now no exploration risk and investors will gain exposure to the potentially lucrative development stage of the cycle whereby a PFS will be completed in anticipation of a Full Mining License award.

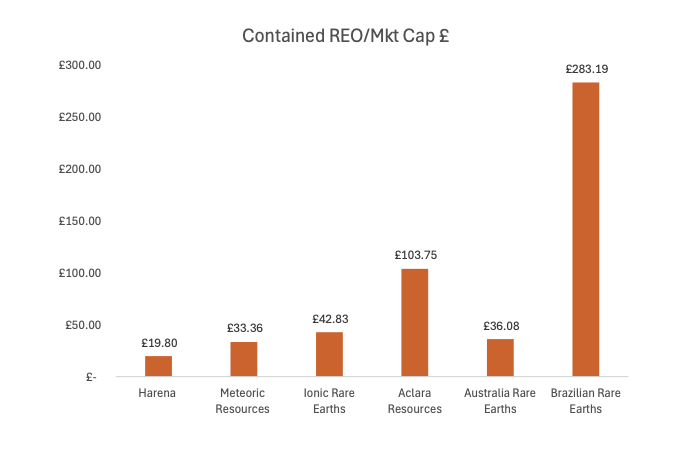

Both of the previous milestones, considering the size and quality of the project would imply a material up-lift from todays valuation of c.£6.5M Market Cap, especially when bench-marking against industry peers, see below.

Geopolitical Neutrality

This topic is becoming increasingly important in todays climate with geopilitical tensions and the effective 'weaponising' of critical minerals by the likes of China, who by the way control around 95% of REE supply, a scary fact!

This means, the likes of non-chinese deposits in Africa, and in Harena's case Madagascar, are increasingly becoming of interest to not only investors, but development finance corporations (likes of the US DFC and African AFC), given the impetus by the EU and US to find independent supply of critical minerals whether that be REE's, graphite, lithium and really any other Chinese dominanated minerals supply chain.

Shareholder Register

Perhaps an odd one to list on a '5 Reasons' blog but a significant one.

Harena came to the market by way of a Reverse Take Over of Citius resources, raising funds to progress Ampasindava at 3p per share. As with the majority of many RTO's, they can come with baggage and in Harenas case there were a number of sellers who were issued shares in lieu of the payment of convertible loan notes.

This puts immediate overhang on the share-price as seen by the initial drop from listing price, however, well known mining investment firm RAB Capital seeing the potential opportunity, have bought the shares from the various sellers increasing its overall stake in Harena to 5.53%

What does this mean?

Well it should me an that the overhang on the stock has now gone and as the interest builds in Harena, the stock has the potential to run back up to re-list price of 3p per share (close to 100% gain from todays share price) and onwards from there as meterial news drops and de-risking milestones are met, particularly when you look at peer valuations.

Peer Valuation Comparison

As mentioned above, Harena offers an interesting peer valuation opportunity

The info-graphic below gives you a flavour for Harena's representative valuation to peers at its 3p re-listing price (the stock today trades at c.1.70p for reasons outlined above) implying an even larger valuation gap potential.

Mkt Cap as at 19 March 2025 from investing.com

So as the company progress the likes of the Mining Study, complete the PFS and obtain a Full Mining License, the valuation up-lift could be significant from todays entry level.

Summary

Harena is understandably, not on many radars yet given its a new entrant to the London Market and the stock has taken some time to settle.

However, despite the general risks that should always be considered when investing in Small Cap companies, we've outlined here, 5 compelling reasons to look at Harena, add it to your watch-list and research the company further, partcicularly now the shareholder register has been cleaned-up and some 'TR1 money' has moved in.

If you want to here more from the CEO, have a listen to our episode of Meet the Manager, featuring Joe Belladonna, CEO below.