Oxford BioDynamics - On the Cusp of a Major Partnership?

A revitalised Oxford BioDynamics have been laying the foundations to strike a partnership that would take their market leading precision medical tests out into the global marketplace - a potentially transformational moment for the company.

Oxford BioDynamics were on the cusp of administration towards the end of last year as the company ran its cash reserves down to a dangerous level.

It's probably then no surprise that the share-price has continued to tumble from the once dizzy highs of 250p+ per share to just 0.4p today.

Basically, the company in my opinion is all but priced to fail and sentiment is on the floor, yet recent news-flow indicates this should not be the case and eagle-eyed investors who have spotted this may well see a compelling risk v reward case here given the huge upside potential on offer if a few key things happen.

So lets quickly recap on the business and review the bear and bull case together.

The Portfolio & IP

OBD position themselves as 3D Genomics experts and have developed their own EpiSwitch technology that translates into a number of key health tests the company are selling into the market. The company has laboratories in the UK, US and Malaysia.

Perhaps when you read through the following, you'll see that a Market Cap of just c.£7.5m for a portfolio of commercial tests and the IP/Technology they are built on and the accrediation they have received, appears, well significantly undervalued, with many arguing it could be 10x that!

EpiSwitch PSE

Perhaps the most prominant of OBD's current test offering is EpiSwitch PSE. 15/20 men currently having high PSA levels when doing a PSA test never go onto develop Prostate Cancer. However, a high PSA reading normally means an invasive follow-up biopsy of the prostate which is very uncomfortable and in worse cases can cause impotence.

This is where the PSE test comes in, using this in conjuction with PSA not only provides a 94% success rate in identifying prostate cancer/risk, it eliminates the need for follow-up biopsies saving time, money and pain! where on-going monitoring of the patient can suffice.

EpiSwitch CIRT (Checkpoint Inhibitor Response Test)

The worlds first test to assess the probability of therapeutic success of checkpoint inhibitor therapy with high accuracy. This test helps idenitify whether patients will respond to certain treatments and of course if not, the patient will not likely go through the process of a specific immunotherapy that is not only resource intensive, but a negative experience/outcome for the patient.

EpiSwitch Explorer Array Kit

The EpiSwitch® Explorer Array Kit facilitates unbiased 3D genomic biomarker discovery and profiling for academic and clinical R&D.

The above products and tests are already commercialised and generate sales for the company (i.e. the GoodBody Clinic use some of them and the company are in talks with the likes of BUPA which could be transformational), but going back to our earlier discussion, whilst sales are increasing MoM and there are promising discussions in progress, the company need to scale and the only way to do this in a short time-frame is partner up with distributors and other Pharma companies etc.

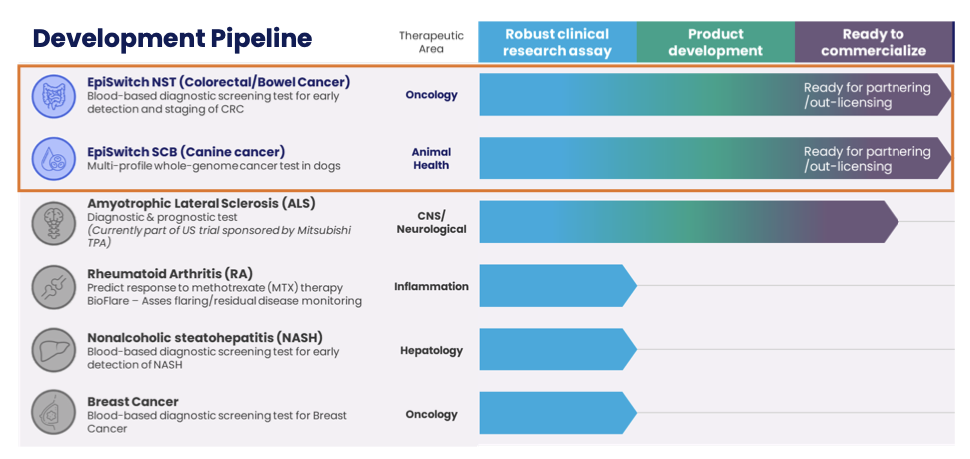

Pipeline

It's worth noting that the company are still doing what they are good at and have a pipeline of products/tests in development. The growing pipeline includes diagnostic/prognostic tests for early-stage detection and staging of prostate cancer and colorectal cancer, diagnostic, prognostic, predictive and monitoring tests in indications such as rheumatoid arthritis (RA), amyotrophic lateral sclerosis (ALS, also known as Lou Gehrig’s Disease or motor neuron disease), multiple sclerosis (MS), lymphoma and other cancers and, in veterinary medicine, a diagnostic/prognostic test for canine lymphoma.

EpiSwitch NST (Colorectal/Bowel Cancer)

This is another Blood Test for screening of Colorectal Bowel Cancer (early detections and removal of Polyps) and the product is ready for partnering/out-licensing. The NST Blood Test outperforms all other CRC tests and as such could be a major contributor to OBD's forward success.

Recently chatting to the company, it appears despite the company's Prostate Test being the 'golden child', their is significant industry interest in the Colorectal/Bowel Cancer test and I guess that's not surprising given we can all probably name someone we know who has been diagnosed with the illness. I think this one could be big for the company and a potential 'dial mover'.

EpiSwitch SCB (Canine Cancer)

This is a multi-profile whole-genome cancer test for dogs and again this test out-performs all other Canine Cancer tests. In a world where people treat their dogs a family, this test could make its way into the mainstream veterinary market-place with the right commercialisation and could again be a major milestone for OBD. This test is again, is ready for partnering/out-licensing.

Additional Partnerships & Accredited Lab

The company recently announced additional EpiSwitch PSE partnerships with Regina Maria (the leading medical services provider in Romania) and BUPA UK Insurance a leading health insurer in the UK with around 3.9M customers

And just last week the company announced that their Oxford Lab has been accredited by UKAS to run EpiSwitch® Clinical Tests in the UK. This will rapidly increase the turnaround times for both PSE and CIRT tests potentially increasing take-up and ultimatley sales of these leading tests.

What will move the dial ?

As the saying goes 'into big trees, do little acorns grow'.

For balance, we need to assess risk, like we do with all Small Cap investments. The company have not covered themselves in glory to date, that's a fact and you'd lay the blame firmly at Management's door. The company also has relatively high overheads, you dont run a regulated Pharma company for tuppence so funding is an issue, however;

If you have been watching the newsflow you'll see the company this year have struck additonal partnerships with BUPA and Regina and received UKAS accreditation for their UK Lab. This is all great progress and shows industry peers that will be watching OBD that they are here to stay and protect their coveted IP, and make no mistake, the vultures will be circling and hoping for something like a fire-sale or something to pick up this valuable IP, not the case says Iain Ross, Chairman.

In my opinion, with what should be sufficient cash for all but the remainder of the year, and the fact that there is increasing media coverage and Industry interest in OBD's market leading tests, some of these having just got to commercialisation stage, OBD are in a potential sweet-spot whereby it's just quite possible their could be a bun-fight to secure a partnership with them whether that be licensing/royalties or distrubition.

So will we find out soon who jumps first? This'll be the dial-mover and perhaps, enough of one for OBD and its shareholders to see a valuation more representative of a market-leading Pharma company that once traded 100's of Million's Market Cap, if of course, Management finally execute.