Touchstone: The largest on-shore Oil & Gas Producer in Trinidad just got larger!

Touchstone are now at an inflection point and now control all of the Oil & Gas infrastructure on-shore Trinidad following the recent acquisition of Shell - Central Block. With an aggressive well development programme, the company also have some exciting exploration plays, on trend of Exxons Guyana world-class discoveries

Touchstone is the largest Oil & Gas producer in Trinidad and with its recent acquisition of Shell - Central Block Trinidad, it just got larger!

Touchstone’s current proven and probable (2P) reserves total approximately 50 million boe, supported by a solid reserve life and a valuation of over $670 million pre-tax. Average daily production reported for Q1 2025 totalled 4,317 (boe/d). Despite the companies name - Touchstone Exploration, it's now a well established production, development and exploration company!

It's probably fair to say however that it's been bit of a bumpy road over the last year or so with the company not meeting initial guidance and some decline in production YoY. Chatting with CEO, Paul Baay (interview below) there are a number of reasons why this was the case including:

- Development wells flowing at very high rates initially, then flattening out

- Some rig and well-bore issues now resolved

- Development infrastructure and permitting taking longer than expected

- Lack of initial data to model accurate guidance

The company have addressed the above and with more well data, can now more accurately model production going forwards, in fact Paul describes the last year or so as effectively the 'boring stage' from an investors perspective as a lot of effort has been spent on stabilisation and of course working on the acquisition from Shell of Central Block Trinidad, perfectly located to Touchstone's existing acreage.

Tipping Point...

The company are now however positioned for growth and have a solid platform to work from given the recent $20M raise and $30M debt financing. The debt financing more than covers the Shell CB acqusition (more on that in a minute) with the remaining £20M equity financing, providing capital for an agressive well development programme and G&A. The company are fully funded for the forward work programmes.

Shell Central Block Trinidad Acquisiton

This deal, according to the company was 5 years in the making and Paul describes the Central Block as the 'holy grail' of on-shore oil & gas Trinidad, and it fits perfectly into Touchstone's portfolio with immediate synergies evident.

Whilst the Central Block asset is very mature it still has an estimated lifespan into 2040 and the acquisition can be described as a game-changer for the company for a number of reasons including:

- Adds c.2000boepd to Touchstone's bottom line for 15+ years

- The plant is inter-connected to all pipelines on the Island

- The plant provides access to the premium LNG markets

- Building an equivalent plant today could cost c.$60-80M

Touchstone have secured the asset for just $23M, so why did Shell sell it ?

Well a Global Oil & Gas Behemoth like Shell, carefully balances its global operations and recently mandated a percentage reduction in global operations including Trinidad.

Central Block only accounts for around 5% of Shells Trinidad production and as a mature asset seems an obvious choice particularly considering that Shell is mostly off-shore focused. What is essentially small-fry to Shell is a meaningful addition to a junior oil & gas companies portfolio, and this is where deal making can be done!

Although production at Central Block is stabilising in its later life, Touchstone believes there is plenty of scope to enhance the asset including optimization of facilities, execution of infill drilling, and pursuing deeper drilling targets in hopes of extending field life and enhancing recovery.

Development Roadmap

With the company now fully-funded, they are now well placed to progress their high impact development programme, where cash will be deployed immediately into drilling wells.

The company plans to drill up to 6 development wells over the next 6 months (more than they've done in the last few years!) with wells planned at Cascadura (2 initial wells), then moving down to Central Block to drill two further wells there and then hopefully back to Cascadura to drill two further wells. Given previous well success in the region being just shy of a 70% success rate, the programme could be very lucrative.

Updated Guidance

Alongside the well development programme, the company are working on revised production guidance which will factor in Central Block, this should be available when the company have the full CB data-set from Shell and will hopefully be published in the coming weeks.

Exploration Upside

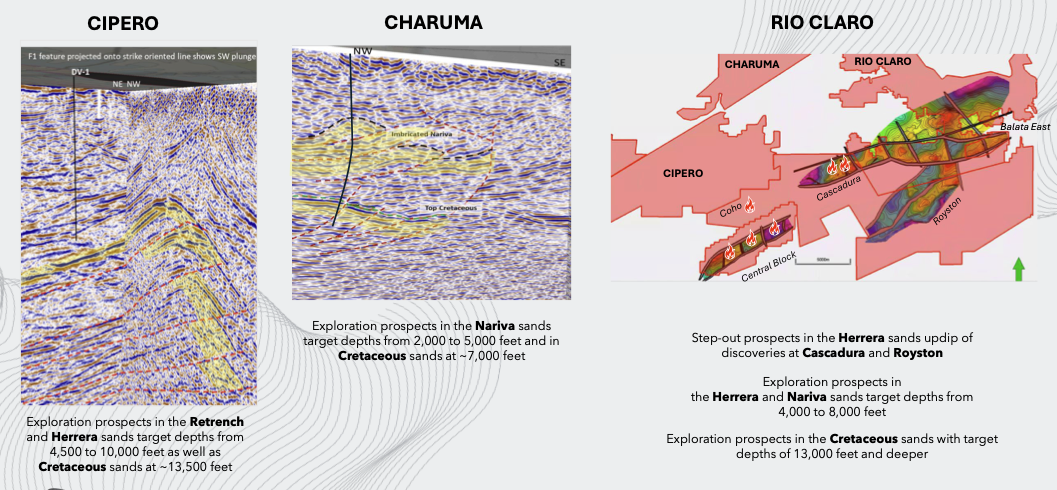

In addition to an active development programme,Touchstone have an exciting exploration programme too and plan to deploy 20% of their capital going forwards into the programme. The company were recently successfull in the on-shore bid round securing three additional blocks. The overall forward exploration programme will comprise two distinct elements:

- Exploration targets similar to those of Touchstone's existing producing assets.

- Deeper exploration plays into the Cretaceous Sands

The deeper plays (shown above) into the Cretaceous Sands are particulalry exciting as this is what Exxon have been drilling in Guyana and the trend extends up into Trinidad. The company plan to utilise an updated model that Exxon have been using in Guyana to drill targets to around 10-13,000 feet.

CEO, Paul says that any success here could make the companies existing assets look 'quite small' and that is not surpsising given Exxon’s Guyana success, with the 'world-class' Liza discovery and multiple descoveries since ultimately amassing 10+ Bboe of recoverable resources circa ~18 major discoveries by 2020.

Conclusion

Despite some hicups along the way, Touchstone have now laid solid foundations for growth, the 'hopper is now full'!

Following the well executed acquisition of Central block from Shell, the company now control all of the on-shore oil & gas infrastructure in Trinidad, a highly industrialised island requiring more oil & gas than is currently domestically available, and with the bonus of access to the premium LNG markets.

Fully-Funded, the company have already embarked on their aggressive well development programme with up to 5 further wells being drilled over the remainder of the year which includes development wells at Central Block.

The company now appear to be at a turning point whereby the vision of becoming a mid-tier oil & gas company is not just a dream but becoming a reality!